categories

89th Legislative Session Proves “Historic” for Public Education, But More Work Needed

October 24, 2025

A Recap of Texas’ 89th Legislative Session

As state lawmakers assembled in Austin back in January 2025, there was every indication that the 89th Legislative Session would be a “historic” legislative session for public education.

Now, with the dust settled after a regular session and two special sessions, 140 days of hearings, debate, and votes, it’s clear that the 89th Legislature was indeed a transformative session for public education in Texas. However, it also highlighted the significant work still needed to fund and support our public schools and their 5.5 million Texas students.

After the 89th Regular Session was over, public education and a directive to “Eliminate the STAAR Test” showed up in two special sessions. Read our statement on the passage of HB 8 to learn more about the decisions made during the second-called special session.

The big headlines from the 89th Legislative Session

With more than 1,200 education bills filed and over 100 passing both chambers, there’s a lot to track and dissect from this legislative session. Here are the big “headlines” from the 89th Legislative Session:

- $8.5 billion in new school funding

- significant investment in teachers and teacher preparation pipelines

- $1 billion for a new universal voucher program

- increase in state mandates for public school classrooms with a focus on parental rights, DEI bans, and library materials

- $10 billion to expand property tax relief

- creation of a new statewide Student Success Tool assessment system that will be implemented in the 2027-28 school year

Dig deeper into these headlines and milestones from the legislative session in our 2025 Legislative Recap Report.

Texas has long touted its national rankings in job creation, economic growth, and its pro-business environment, but did this session measure up in terms of investment in our state’s future, our public school students? That’s a tougher question to answer.

What’s clear is there’s still work to be done to address some historic funding challenges for public schools, students, and teachers. And given that our economic growth and long-term prosperity rests with the next generation of leaders, innovators, and entrepreneurs – our K-12 public school students – we’re hopeful that Texas lawmakers will return in 2027 to further invest in the future of our state.

Texas has the resources to do better, and when lawmakers work across the aisle and across the Senate and the House, Texas public schools, families, and local communities are all better served.

Beyond the big headlines, let’s look at four key bills

Four big bills surfaced as the focus of the Legislature’s work during the 89th Legislative Session: House Bill 2 (HB 2), House Bill 4 (HB 4), Senate Bill 2 (SB 2), and House Bill 8 (HB 8). Three passed, one failed. Here’s what you need to know about each major piece of legislation:

House Bill 2: “Historic” school funding – PASSED

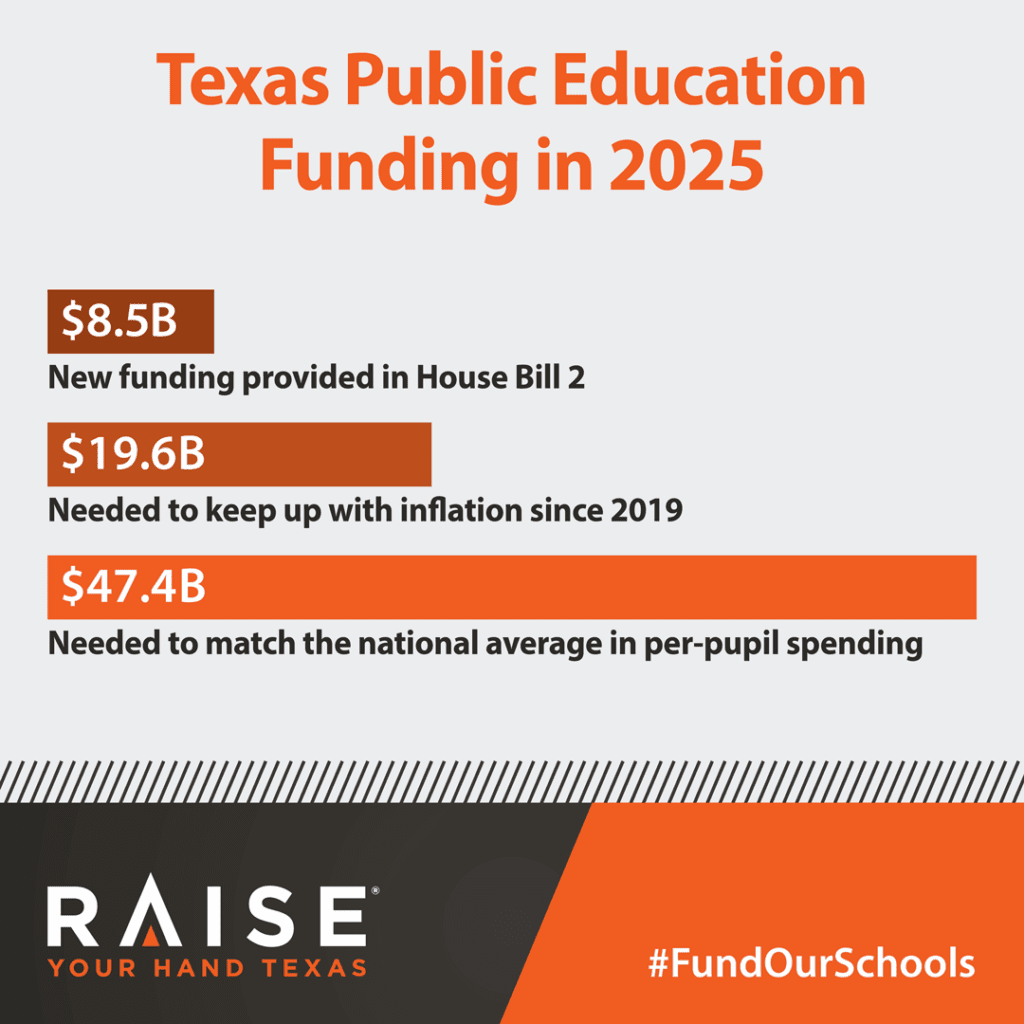

The $8.5 billion school funding package, as found in HB 2, received bipartisan support and delivered the largest-ever permanent pay raise from the state for Texas teachers. The largest portion of the funding in HB 2 provides most teachers with a targeted salary increase based on school district size and a teacher’s experience.

Sizable investments were also directed to special education and school safety. HB 2 creates a $1,000 grant to support the cost of all initial special education evaluations and adopts an “intensity of service” funding model, which will direct special education funds to school districts based on individual student needs. Early estimates anticipate that these changes will inject $850 million into special education programming, which accounts for only half of the reported $1.7 billion deficit for special education services.

The bill also doubles previous school safety funds by raising the per-campus safety allotment from $15,000 to $33,540 and the per-student safety allotment from $10 to $20. School districts have raised concerns about the inadequate funding for meeting the state’s expensive and rigid school safety requirements, which include having full-time armed security personnel and state-of-the-art alert systems.

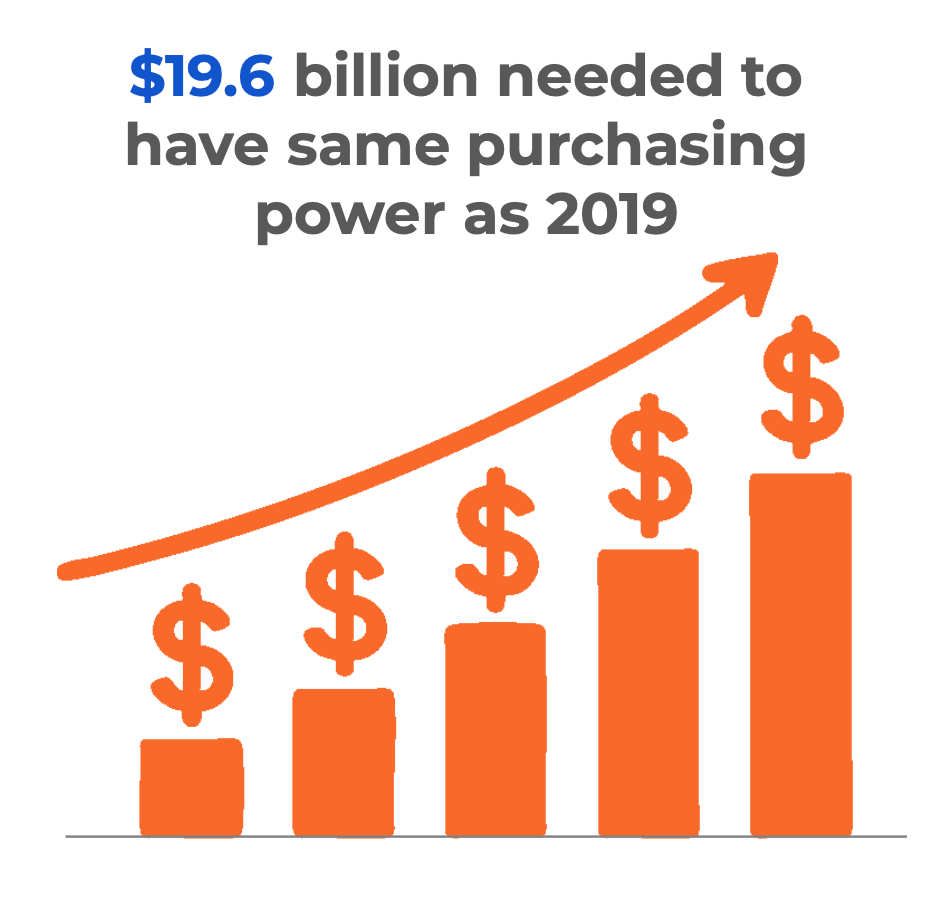

While these investments are meaningful, the “historic” moniker belies the reality that a significant funding gap for public schools remains. This session, Texas public schools needed an infusion of $19.6 billion in state funding to maintain the same purchasing power as in 2019. The legislature created a new funding stream, the Allotment for Basic Costs, which allocates $1.3 billion to cover school districts’ costs of certain non-salary operational needs, such as transportation, retire/rehire fees, insurance premiums, payroll taxes, and utilities.

This minor financial bump is generated by freezing the funds that school districts generate from locally approved tax rate increases at a certain level and transferring any funds generated above that level to the basic allotment. This means the $55 amount is not a fixed increase, but rather subject to fluctuations in property values.

The increased basic allotment is not a fixed increase. It is subject to fluctuations in property values.

The increased basic allotment is not a fixed increase. It is subject to fluctuations in property values.

Moreover, because this increase is a transfer from one component of the school finance system (local tax rate collections) to another (the basic allotment), it will not deliver or result in increased funding to every Texas school district. Ultimately, the scale and design of this “increase” do not offer sufficient support to protect school districts from budget deficits and shortfalls in the foreseeable future.

House Bill 4: Testing and accountability reform – FAILED

HB 4 was one of the most divisive education bills filed this session, as the House and Senate saw this bill as an opportunity to address two distinct priorities:

- eliminating the STAAR test

- preventing legal battles from disrupting the accountability system

These priorities were rooted in fundamentally different beliefs, making it difficult to find common ground. Ultimately, the chambers failed to find a path forward before Sine Die of the regular session.

Raise Your Hand Texas supported the House’s version of HB 4 as it aligned with the policy recommendations developed from our statewide Measure What Matters campaign. This statewide campaign included more than 15,600 school leaders, parents, students, business leaders, accountability experts, and more, all sharing their knowledge and expectations of high-quality public education. The House’s version of HB 4, which passed with a 143-1 vote out of the House, would have brought long-needed reforms to modernize our state’s assessment and accountability system. It would have provided teachers and schools with more meaningful, actionable data, and it would have delivered clarity to parents about how local schools are supporting the growth and success of their children.

Key provisions of HB 4 included:

✅ Replacing the STAAR test with a more flexible system built on through-year nationally-normed referenced tests, with faster results and more accurate tracking of student growth

✅ Reducing the number of mandatory standardized tests by aligning with the minimum requirements under the Every Student Succeeds Act

✅ Expanding the A-F system by incorporating optional non-testing indicators to rate school districts on student engagement and workforce development metrics, such as: pre-K enrollment, early career and technical education participation, extra- and co-curricular completion, and advanced coursework completion

✅ Prohibiting standardized test performance from comprising more than 40% of a high school campus’ A-F rating

✅ Requiring legislative approval for major changes to the accountability indicators, domains, and weights

✅ Establishing strict deadlines on rule changes to the accountability system along with a two-year advanced notice of upcoming changes

✅ Creating parity with private school testing requirements established under SB 2 (89-R), the education savings account/school voucher bill

✅ Allowing school districts to challenge accountability rules under an expedited legal process

Why were these changes to HB 4 so significant? Here’s the understated value in nationally norm-referenced tests.

These provisions leverage the best tools and practices to ensure our schools provide students with meaningful and growth-oriented support. The reality is that most school districts already use TEKS-aligned norm-referenced testing to target each student’s unique learning needs–on top of administering the STAAR test every year. Many of these nationally norm-referenced assessments are adaptive, meaning they cater to each student’s needs, and the results are available within one to three days, allowing educators to quickly implement targeted interventions that promote achievement.

Along with better tests, expanding the A-F system to incorporate student-centric indicators incentivizes school districts to prioritize practices with proven results. Research consistently demonstrates that attending pre-K, completing advanced coursework, and participating in extracurricular activities translates to immediate and long-term academic achievement for students.

Having an accountability system that captures this important and high-impact work creates more transparency for parents who deserve to know the full extent of support their students receive. It also allows for a more accurate evaluation of school quality, which cannot be defined by standardized test scores alone.

Finally, setting guardrails around the rulemaking process of the accountability system protects school districts from the disruptive impact of drastic changes. This ensures that proposed changes have community buy-in and that school districts have a realistic runway to effectively adapt.

Although HB 4 ultimately failed to pass, the fact that it received widespread support from educators, parents, and other stakeholders – and sailed through the House with a 143-1 vote – gave Raise Your Hand Texas hope that the Legislature would pass policy that fully Measures What Matters.

House Bill 8: New statewide assessment system – PASSED

Ultimately, the Texas Legislature passed an assessment and accountability bill in the second special session, but it was significantly different from HB 4. House Bill 8 (HB 8) replaces the STAAR test with a new Student Success Tool, which overhauls the state’s standardized testing system. While it introduces a new assessment model starting in the 2027–28 school year, it leaves the state’s controversial A-F accountability system for rating schools largely unchanged.

What’s Changing:

- Through-Year Assessments: Instead of one big test at the end of the year, students will take shorter tests at the beginning, middle, and end of the year in core subjects (reading, math, science, and social studies).

- Less Testing Time: The new system is expected to result in shorter overall testing times, with strict testing windows to minimize classroom disruptions.

- Fewer Benchmark Tests: The bill limits how often school districts can administer their own local benchmark exams.

- Exam Substitutions: High school students can now substitute qualifying scores from tests like the SAT, ACT, PSAT, or AP exams for their required end-of-course (EOC) exams.

- Eliminated Test: The English II end-of-course exam will be eliminated.

Despite the new testing format, HB 8 does not fundamentally alter how Texas grades its schools and districts. Raise Your Hand Texas has maintained for multiple sessions that the core shortcoming of our accountability system is its overreliance on standardized test scores produced by one test on one day. Texas needs a system with more rigorous and accurate measures of school quality.

What’s Staying the Same:

- A-F Grades Continue: Schools and districts will still receive an annual A through F rating.

- Heavy Reliance on Test Scores: For about 80% of schools, particularly elementary and middle schools, these ratings will continue to be based almost entirely on student performance on standardized tests.

- Future Changes Are Not Guaranteed: HB 8 requires studies on how to incorporate other measures—like student engagement, parental involvement, or advanced coursework—into school ratings. However, these are only recommendations for future legislatures to consider. The bill does not mandate their inclusion.

Essentially, HB 8 changes how and when students are tested, but not how those test results are used to grade schools. The shift away from a system heavily reliant on standardized test scores will require further action in future legislative sessions.

Senate Bill 2: Texas now has an Education Savings Account – PASSED

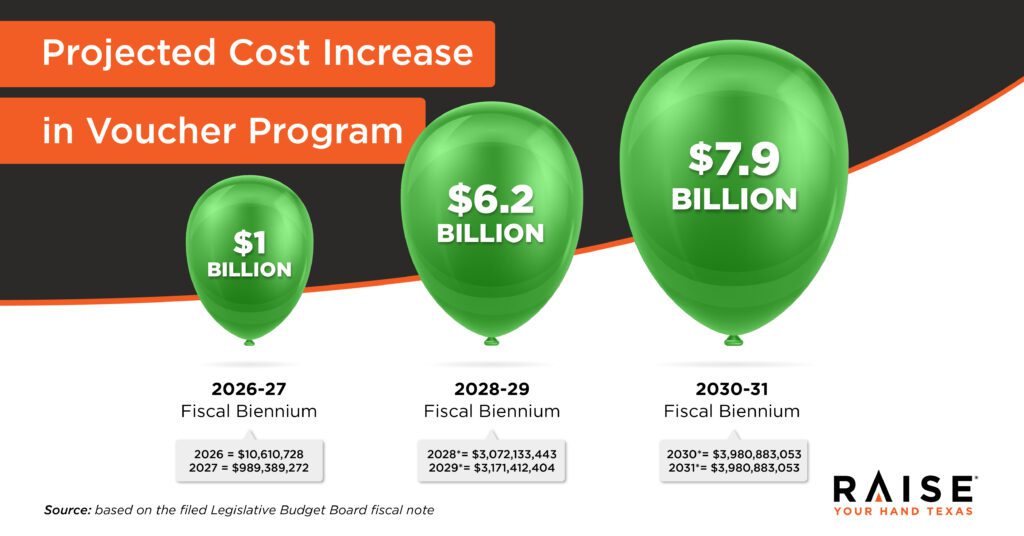

After years of bipartisan opposition, the political winds shifted enough to pass the first universal education savings account, also known as a school voucher program in Texas. Senate Bill 2, signed into law by Gov. Greg Abbott, marks the country’s largest launch of a universal school voucher program. The program opens the door to public funds being used for private school tuition, homeschool expenses, and other approved education-related services. The $1 billion price tag for the 2026-27 biennium, based on Legislative Budget Board estimates, is expected to increase significantly in future years, ballooning to a cost of $7.9 billion by 2030-31.

To address some of the key concerns associated with establishing a universal voucher program, certain guardrails were implemented:

- Only 20% of available funds can go towards students who are above 500% of the Federal Poverty Line (FPL).

- To be eligible, private schools must be accredited and have operated with accreditation for a minimum of two consecutive years.

- Private schools must administer either a norm-referenced test or the STAAR test to students participating in the voucher program.

- Test results must be reported to the Texas Education Agency.

- Students who return to public schools mid-year are not counted toward the A-F ratings for that school year.

- A state auditor must verify student eligibility and expenditure reports of voucher-funded private schools.

While these guardrails offer some assurance that voucher-funded private schools will be held accountable, they fall short of parity with the strict academic and financial accountability requirements that public schools adhere to.

Unlike their voucher counterparts, public schools are not given the option to use nationally norm-referenced assessments for accountability purposes. Moreover, voucher-funded private schools will not be subject to an A-F rating for their students’ test results. Similarly, these private schools will not be subject to the same 21 indicators of financial accountability as public schools through the Financial Integrity Rating System of Texas, which evaluates the timeliness of payroll and debt obligations, fund balance status, asset-to-liability ratios, and other factors.

Vouchers will be distributed in accordance with a prioritization scheme laid out in SB 2, with students in the highest priority categories first in line to receive the funds. If the number of applications exceeds the available funding, a lottery system will be used to determine who receives ESA funds.:

- students with disabilities whose family earnings are below 500% of the Federal Poverty Line (FPL)

- families earning below 200% of the FPL, which is less than around $64,000 for a family of four

- families earning between 200% and 500% of the FPL, which is roughly between $64,401 and $160,000 for a family of four

- families earning more than $160,000 annually, which is 500% over the FPL

Importantly, the new school voucher program caps funding for families earning more than $500,000 annually by allocating no more than 20% of the program’s total budget to participants with household incomes above 500% of the federal poverty level.

Read more about the state’s new universal voucher program

A Snapshot of Key Additional Public Education Bills that Passed

Despite the scope of major bills like HB 2 and SB 2, other consequential education bills were also passed this session. These policies also carry operational and/or funding implications for Texas public schools:

HB 6 (Rep. Leach) – School Discipline Reform

This bill modifies protocols concerning student discipline in public schools. Key provisions include:

- limiting out-of-school suspensions to three consecutive days, with no limits placed on in-school suspensions

- permitting out-of-school suspension for students below grade three for conduct that threatens the immediate health and safety of others, as well as repeated or significant disruptions

- expanding teacher authority to remove students from the classroom after one instance of misconduct, with a student’s return requiring written consent from the teacher

- allowing Disciplinary Alternative Education Program (DAEP) placement for off-campus offenses related to felony charges, deadly conduct, or possession of weapons

- permitting the creation of virtual DAEPs in cases where physical DAEPs are inaccessible

- removing mandatory DAEP placement for the first-time offense of on-campus possession of an e-cigarette

HB 1481 (Rep. Fairly) – Cell Phone Ban Policy

This bill aims to regulate the use of personal wireless communication devices by students during instructional time. Key provisions include:

- requiring school districts and charter schools to adopt a policy that either bans personal wireless communication devices on campus or requires those devices to be stored away during the school day

- mandating this policy be adopted by all school districts and charter schools by the 90th day after the bill is enacted

- providing exceptions for students who rely on such devices for medical and/or safety reasons through an individualized education plan or 504 plan

- requiring the Texas Education Agency (TEA) to develop model policy language to help school districts and charter schools implement mandates

SB 4 & SB 23 (Sen. Bettencourt), HB 9 (Rep. Meyer) – Property Tax Relief

These bills aim to provide property tax relief by increasing homestead and business personal property exemptions. Key provisions include:

- increasing the homestead exemption from $100,000 to $140,000 (SB 4)

- increasing the 65 and older exemption from $10,000 to $60,000 (SB 23)

- expanding the business personal property tax exemption from $2,500 to $125,000 (HB 9)

- creating a combined fiscal impact of $4.13 billion for the next biennium

SB 12 (Sen. Creighton) – Parental Rights Expansion

This bill is designed to expand parental rights in educational decisions. Key provisions include:

- requiring parental and written consent for mental health screenings, surveys, medical procedures, and sex education

- prohibiting any district-level Diversity, Equity, and Inclusion duties related to hiring, training, or programming

- mandating districts create an online portal for parents to submit comments; requiring school boards to present parent comments at the start of each board meeting

- requiring instructional materials and syllabi to be posted online for every class; requiring school districts to post online notice of parents’ right to request access and review all instructional materials

- establishing a multi-level appeals process for parental grievances

- mandating school districts publish facility usage reports related to student capacity and student transfers

SB 13 (Sen. Paxton) – Library Materials

This bill seeks to enhance parental involvement and oversight in school library resources. Key provisions include:

- requiring school districts to give parents access to their child’s school library catalog

- giving parents the authority to submit a list of materials they do not want their child to access

- granting school boards the option to create parent-majority advisory councils to review material acquisitions and challenges; mandating councils if petitioned by 10% of districts’ parents or 50 parents, whichever is fewer

SB 569 (Sen. Bettencourt) – Virtual and Hybrid Schools

This bill enhances the flexibility of Texas public schools to offer virtual and/or hybrid instruction to students. Key provisions include:

- repealing the Texas Virtual School Network

- allowing school districts and charter schools to offer individual virtual courses, full-time virtual schools, and full-time hybrid schools

- creating parity in attendance-based Foundation School Program funding between students enrolled in virtual or hybrid courses and students enrolled in in-person courses

- protecting educators from being required to provide in-person and virtual instruction simultaneously; granting an exception if the teacher is not required to interact with the students online (“simulcasting” instruction)

- requiring educators to receive appropriate professional development or be determined as sufficiently experienced by the school district or charter school before teaching virtual or hybrid courses

- protecting educators from being forced to teach virtual or hybrid courses; protecting students from being required to enroll in virtual or hybrid courses

Where do public schools go from here?

While school districts anxiously await TEA guidance on implementing pay raises and new funding allotments, many districts have already adopted their budgets for the 2025-26 school year, and some continue to face budget shortfalls.

As information and new funds become available, districts will have the opportunity to amend their budgets, but time will tell just how much HB 2 helps cover funding gaps. Complex bills only heighten the risk of unintended consequences, and with an already complex school funding system like the one we have in Texas, it is likely that school districts find themselves navigating unexpected hurdles.

When examining the state as a whole and assessing the current needs of school districts, it is evident that the $8.5 billion allocated in HB 2 falls short of the required $19.6 billion. Until school funding is adequately addressed, it will be difficult to avoid harsh budget realities.

How Texas’ property tax compression compromises school funding

Adding to the funding challenge is the aggressive commitment to property tax compression. In the 89th regular session, the state committed $51 billion in property tax relief, which limits the amount of funding school districts can generate locally. Did you know Texas ranks 46th in the nation in per-pupil funding? It would take less money – $48 billion – for Texas to meet the national average in per-student spending than the $51 billion Texas recently committed in property tax relief. This highlights an important truth: Texas can make bold and expensive investments; it’s just a matter of prioritization.

Along with school funding, school boards will begin navigating the new policy mandates from a slew of other education bills. They will have to navigate politically sensitive conversations as they implement rules for regulating cellphones, reporting parental grievances, requiring teachers to publish their instructional materials in advance, and setting up virtual courses for the upcoming school year.

Join us and advocate for Texas public schools

When all is said and done, the work continues. Not just for school district employees, but for all public education advocates. Join us as we work to strengthen our public schools and set all of Texas’ 5.5 million students on a path to success. Learn more about key policy challenges and how to connect with legislators. Together, we can ensure that lawmakers adequately address school funding and accountability issues in our state.

We know the Texas Legislature is capable of passing bold, complex measures when it’s a priority. They make significant investments when deemed necessary. That’s why Raise Your Hand Texas will continue to lift up local communities and advocates to make the case for funding the future of Texas – our public schools and the 5.5 million students in those schools across our great state.

Join us as we work to improve our per-student funding, because Texas deserves to be more than 46th in the nation in per-pupil funding.

Learn more about the significant funding challenges and how you can connect with your legislator in the interim session to ensure the Texas Legislature will tackle school funding and assessment and accountability issues when lawmakers return to Austin in January 2027.