School Vouchers and ESAs

Where We Stand on School Vouchers

Money matters in our public schools – for our teachers and our students – and public dollars should remain in our public schools, supporting 5.5 million Texas public school students.

Raise Your Hand Texas has consistently supported innovation within our public schools to improve student performance and provide a broad range of opportunities to all Texas students.

Today, in Texas, students can access multiple education options within their communities through district open enrollment, magnet programs, STEM andCTE programs, innovative learning academies, and charter schools. Investing in the public schools that serve the vast majority of school-aged Texans should be the state legislature’s focus.

Any taxpayer dollars used for education should require a level playing field that is equitable for all students, provides transparency to taxpayers, and ensures effective, efficient, and consistent accountability.

Unfortunately, school voucher programs and Education Savings Accounts (ESAs) too often divert scarce public education funds to private schools, siphoning tax-payer dollars from public schools and charter schools.

Any public money used for private education should:

- Require compliance with federal protections for students with disabilities; and

- Offer taxpayers a clear line of sight on how those tax dollars are used, including tracking spending and student performance.

With Texas ranking 46th in per-student spending in public schools, it’s time for the State of Texas to deeply invest in public schools, their students, and our teachers.

Vouchers Hurt

Voucher programs in other states have a long history of expanding well beyond their intended scope, even surpassing spending limits set by their legislation, resulting in increased state spending on programs that favor private schools and for-profit entities that administer voucher programs. Vouchers rarely cover the full cost of private school tuition, leaving families who participate in these programs to pay the difference – often thousands of dollars. Yet research also shows vouchers do not improve student achievement.

Vouchers further hurt our public schools by:

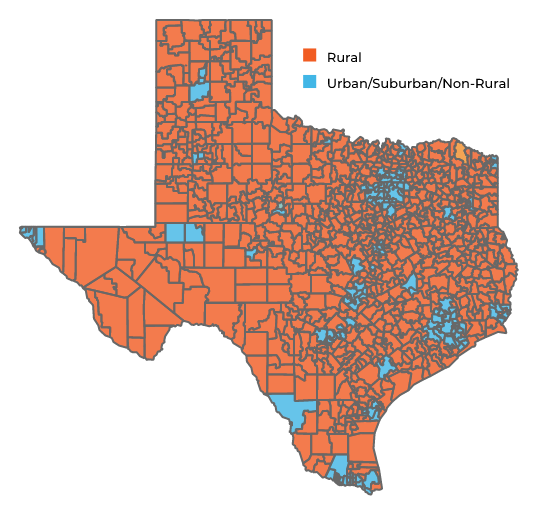

- forcing rural communities to pay into a system they likely cannot access,

- failing to protect the rights of special education students, and

- leaving middle- and lower-class families with hefty bills for tuition gaps and expenses not covered by a voucher.

Our public schools deserve full funding and fair competition. Any other taxpayer dollars provided for education outside of local public schools should provide transparency and accountability for taxpayers and accept all students.

Texas Has Rejected Vouchers For Decades

Voucher proposals have traditionally translated into providing a handful of students with public funds for private school tuition and services at the expense of all other Texas students, teachers, schools, and communities.

For decades, the Texas legislature has roundly rejected vouchers or ESAs. Most recently, the Texas Legislature considered several voucher proposals during the 88th Legislative Session (2023), but the legislation did not pass.

Headlines and reports abound regarding the potential hazards for Texas families, schools, and communities if vouchers are adopted. Rural Texas, in particular, could suffer if funding is removed from public schools, which are the lifeblood and major employer of many small communities.

Even though many small towns do not currently have private schools, other states have demonstrated that loosely regulated Education Savings Account (ESA) vouchers promote the creation of new pop-up schools and vendors who are willing to accept voucher funds but do not provide transparency or accountability for what their students are learning.

Voucher or ESA programs in other states often have varying mechanics or eligibility requirements, and costly administrative burdens to implement and manage. Any state taxpayer dollars used for private or for-profit education should not come at the expense of public schools, their students, or our teachers.

We can’t afford to divert hundreds of millions of taxpayer dollars from our public school students and teachers when we rank among the bottom 10 states in per-pupil public school funding.

Making an Impact

Texas lawmakers should prioritize public dollars for public school students and teachers by:

- Providing fair access to educational opportunity;

- Increasing investments in public schools, students, and teachers;

- Protecting funding for all public schools, including in rural communities;

- Preserving the rights of students with disabilities, and

- Ensuring tax dollars are used appropriately.

Texas cannot afford to remain 46th in per-pupil spending for public schools. Our future economy and workforce are at stake. Texas lawmakers must invest in our public schools, students, and teachers first. Let’s #FundOurSchools and put our students first.